CBDT 2025 new updates (Central Board of Direct Taxes)

CBDT 2025 new updates- In 2025, the Central Board of Direct Taxes (CBDT) will still be key in designing the country’s direct tax system. CBDT, as the main authority in the Department of Revenue, Ministry of Finance, manages and carries out policies related to income tax, corporate tax, and various allied areas. Because of quick changes in technology and the economy, CBDT has implemented large reforms to ensure the system is transparent, efficient, and friendly for taxpayers.

What does CBDT mean?

The CBDT is responsible for the Income Tax Department and guides tax policy, enforcement, and monitoring. The body has a chairman and six members, each in charge of legislation, investigation, care for taxpayers, and auditing. In 2025, the CBDT will work towards the government’s goal of being “Minimum Government, Maximum Governance” by concentrating on simplifying, digitizing, and making the tax system transparent.

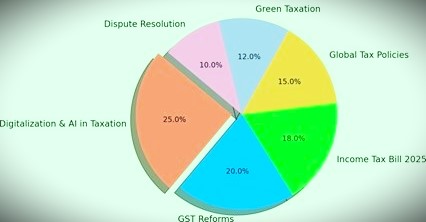

2025 Important Updates for CBDT:-

- Reviews and Appeals without Names

The introduction and improvement of the Faceless Assessment and Appeals Scheme is a major achievement for the CBDT. Previous efforts, which aimed to replace human connection and ensure clear decisions, were improved with AI-assisted data analysis and automated methods in 2025. It has improved taxpayers’ faith because it allows less harassment and ensures all are treated the same in tax evaluation. - Connecting Data Analytics and Artificial Intelligence

CBDT is using data analytics, AI, and machine learning to help detect tax evasion and study money movements. By 2025, artificial intelligence will help authorities to quickly and easily spot players involved in tax crimes and suspicious businesses. These systems assist the Income Tax Department in choosing the right actions and investigating specific cases, without inconveniencing lawful taxpayers. - Online Tax Help

The CBDT’s new e-filing tool is now fully established as a robust platform with the ability to handle grievances quickly, file returns quickly, respond to users through chatbots, and support various languages. Taxpayers can use the portal to file their forms, see their refunds, and interact with tax offices without problem.

Taxpayers have found it easier, faster, and more accurate to comply because the CBDT offers its services online.

Plans for the Policy Focus of CBDT in 2025:-

- Making Tax Laws Easier CBDT is committed to making tax laws simpler and more logical in the year 2025. Many old and overlapping parts of the Income Tax Act have been removed or combined, so it is easier to understand and apply. Key parts of the tax reforms include new slabs, help for start-ups, and aid to middle-income groups.

- Working Together and Transfer Pricing

Since the economy is globalized, CBDT cooperates with other countries to handle BEPS. In 2025, the Board has made transfer pricing rules stricter, created better Advance Pricing Agreement (APA) programs, and brought its practices in line with OECD rules. - Encouraging organizations to freely follow the law

With educational drives, online webinars, and media activities, CBDT urges people to pay their taxes voluntarily. Thanks to the Taxpayer Charter, both the expectations and rights of taxpayers are clearly outlined.

Difficulties and What Lies Ahead:-

CBDT has done well, but there are still some problems to overcome:

Rising numbers of lawsuits and longer waits for cases to be settled

Keeping data and cybersecurity safe

Helping small taxpayers in rural areas catch up on digital services

To solve these problems, CBDT is currently working on the following:

Machines that solve conflicts using AI

Promoting programs to teach about taxes

Developing good cybersecurity systems

The CBDT plans to create revenue prediction models, strengthen cooperation among tax officials, and advance efforts to make the tax system fully digital.

Conclusion:-

In 2025, the Central Board of Direct Taxes is leading the way in India’s tax reforms. Because of its emphasis on digital progress, reducing complex laws, and focusing on taxpayers, the tax administration is becoming modern. With the help of technology and by making things clear, the CBDT is both raising taxes and gaining the public’s trust. Since India is striving to become a $5 trillion economy, the function of CBDT in shaping a fair, efficient, and progressive tax system is now more important than ever.